Debt Trap Looms as FG Exceeds 2024 Borrowing target

President Bola Tinubu is set to present the 2025 national budget to the National Assembly tomorrow, largely tasked with funding by borrowings; meanwhile, the Federal Government (FG) is set to exceed its domestic borrowing target for 2024 by N4 trillion, 67 percent above the budgeted amount.

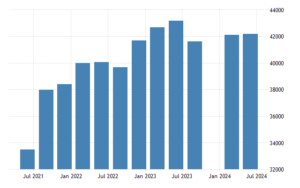

This development comes amid growing concerns about the country’s rising debt levels. Government data for the first 11 months of 2024 reveals domestic borrowing has already surpassed the target by N2.93 trillion, marking a 49% overshoot as of November.

Based on the Financial Vanguard report, it shows that FG had borrowed N8.93 trillion from domestic investors against the N6 trillion budgeted for the whole year in the eleven months of 2024 {January to November}, 11M’24.

The FG, with this development and other borrowing activities implemented, might eventually end up borrowing N10 trillion in 2024, which is 67 per cent above the target for the year.

This is happening as the federal government plans to address the 2025 budget deficit through domestic and external borrowings totalling N9.22 trillion, which represents an 18% increase from the N7.808 trillion projected for 2024.

According to the Federal Ministry of Budget and Economic Planning, the 2025 deficit budget report would be funded “by new foreign and domestic borrowings of N9.22 trillion, N312.33 billion from privatisation proceeds, and N3.55 trillion drawdowns on existing multilateral/bilateral project-tied loans. The deficit will largely be financed by domestic borrowings, considering the narrow window for external financing.”

Details of 11M’24 FG Securities

According to data from the Debt Management Office, DMO, and the Central Bank of Nigeria, CBN, in the third quarter, Q3, 24, the Federal Government had borrowed N2.134 trillion from domestic investors through the Nigeria Treasury Bills, NTBs, FGN Bonds, and FGN Savings Bonds.

Borrowings through the NTB auctions conducted by the CBN stood at N1.181 trillion, while FGN bonds and FGN savings accounted for N939.246 billion and N14 billion, respectively.

More analysis shows that in October and November this year, the Federal Government also borrowed N774.953 billion through NTB. FGN Savings Bonds amount to N635.752 billion, and FGN Savings Bonds amount to N7.152 billion.

Domestic Borrowing in H1’24

Further, according to the recent data released by the DMO, the Federal Government’s domestic debt stock for the first half of the year, HI’24, stood at N66.957 trillion, representing 38.6% growth from N48.314 trillion in HI’23.

CBN borrowings through NTBs rose to N11.8 trillion in H1’24 from N4.7 trillion in H1’23 and accounted for 17.64% of the total FG’s borrowing.

Federal Govrnment’s borrowing through the monthly FGN Bond auctions, which constituted 78.13% of total FG borrowing during the period, rose to N52.315 trillion in HI ’24 from N41.722 trillion in H1’23.

FG’s borrowing through Sukuk Bonds, which accounted for 1.6% of total FG domestic borrowing during the period, rose to N1.092 trillion in HI ’24 from N742 billion in H1’23.

FG’s domestic borrowing through FGN Savings Bonds accounted for 0.08% of total FG’s borrowing during the period and also spiked, rising to N55.196 billion in H1’24 from N30.704 trillion in H1’23.

Analysts’ View

However, analysts and economic experts have noted that the Federal Government’s 49% excess domestic borrowing in the first 11 months of 2024 was largely influenced by investors’ reactions to the high-interest rate environment. This was driven by the Central Bank of Nigeria’s (CBN) cumulative 875 basis points hike in the monetary policy rate (MPR) during the period.

Starting at 18.75% in February, the CBN gradually increased the MPR to 27.5% by November 2024. Consequently, the interest rate on 364-day Nigerian Treasury Bills (NTBs) surged to 22.93% in November from 12% at the beginning of the year, marking an 11.91 percentage point rise compared to 4.44% in the first half of 2023.

Similarly, the average interest rate on the Federal Government of Nigeria (FGN) Savings Bond with a two-year term climbed to 17.483% in December 2024, up from 12.287% in December 2023.

David Adonri, Analyst/Executive Vice Chairman at Highcap Securities Limited, reviewing the fiscal position in 2024, stated: “To different elements in the economy, rising debt and rising yield on debt mean different things. While the investor in debt is happy and smiling at his bank, corporate debt issuers are groaning because of the escalated cost of borrowing and the crowding-out effect of public borrowing.”

Above all, rising public debt signals an expansionary fiscal policy that is inimical to the effectiveness of tightened monetary policy.

”FGN is already in a debt trap, requiring new debt to service existing obligations. This leaves very limited financial resources for economic development. If the reckless piling of debt by FGN continues, a sovereign default might become imminent.

”Notwithstanding the influence of the high interest rate regime, the sharp rise in FG’s borrowing from domestic investors is inimical to the private sector as it makes it more costly for businesses to borrow.”. Also, the higher lending rates have led to inflationary pressures as the corporations have to increase prices to cover for the higher borrowing rates.

“With respect to monetary policy, whilst the Central Bank continues on its hawkish trend, we expect pressure from the government on the Central Bank as its debt service costs rise.

”The government cannot afford to borrow at these levels for an extended period of time. Government spending has also led to more pressure on the currency, as it means more Naira is available to chase the dollar.”

He went further, saying, “With respect to fiscal policy, we are yet to see the borrowing by the government have an impact on fiscal policy. Yes, we have the coastal roads being built, but we would like to see more with regard to policies to help increase production output in the economy.

”Also, we expect to see a significant increase in debt servicing costs, factoring in the higher rates and increase in domestic borrowing.”

Also speaking to Financial Vanguard on the situation, Victor Chiazor, Head of Research and Investment at Fidelity Securities Limited, FSL Securities Limited, said: “The government borrowing has fuelled inflationary pressures.

”In addition, there’s an indirect effect on exchange rates. Also, there’s the crowding-out effect for private sector lending. As it is, not many businesses can afford to borrow at the elevated interest rate.

”Finally, the monetary policy response to all this may be to continue to raise interest rates in a bid to tame the spiralling inflation.”

Dr. Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprise (CPPE), also voiced out, saying, ”There is a general need to moderate borrowing so that it doesn’t overheat the economy.

“With respect to the implication for inflation, the deficit, if financed properly, may not be inflationary.

“An inflationary component of deficit financing often arises when CBN prints money to finance the deficit. That is when you have serious issues with inflation because the money is now what you call high-powered money.

”But if it’s funded using bonds, Treasury bills, and other forms of borrowing, either from the public or from within the financial system, it is less inflationary.

“If the debt level continues to increase, of course it has a crowding-out effect on the private sector. That means more of the credit in the economy will go to the government as opposed to the private sector, which is not a particularly good thing.”. So we need to worry about a trend of increasing domestic debt because of the risk of crowding out the private sector in the credit market.

“For fiscal policy, it’s a fiscal policy instrument. Borrowing is a fiscal policy issue; it’s used to fill the gap. Again, what is important is to maintain a sustainable ratio as far as borrowing is concerned: the ratio of debt service to revenue and the ratio of debt to GDP.”

Olatunde Amolegbe, former president of the Chartered Institute of Stockbrokers, also commented, saying, “For me, borrowing is a natural consequence of public expenditure if a country intends to grow. The question, however, is about what the debt is used for.

”I have always had reservations about borrowing to meet recurrent expenditure, which is why I am more inclined towards infrastructure or project-tied debt that one is sure will go towards boosting economic growth and development.

”Of course the borrowing level and borrowing cost are high, and this has negative implications for our finances as a country; however, in as much as the debt-GDP and debt-revenue continue to remain stable or even decline, then debt sustainability should not be a problem.

”I suppose the increase in the volume of FGN’s borrowing we’ve seen month-on-month is driven by the attractive interest rate that they presently offer to investors. It means investors can invest as low as N10,000 and get an interest rate of about 18%, which they can’t get anywhere else.” This can actually be seen through the prism of wealth distribution or empowerment.

”It is therefore not a problem per se but how the fund generated is put to use to enhance production. The private sector wants to see infrastructure that would help them reduce the cost of production.”.

Also, Tajudeen Olayinka, investment banker & stockbroker, said, “I think the critical challenge there is the sustainability of debt as measured by (i) debt-to-GDP ratio, (ii) debt-to-revenue ratio, and (iii) debt-to-export ratio.

”The more sustainable a country’s debt is, the less burdensome it becomes to the economy. Accordingly, Nigeria’s economy must become more productive in the immediate to near term for her to sustain the current level of debt stock.” This should be the focus of the current administration, even though it inherited a huge debt service-to-revenue ratio that had become unsustainable from the administration of President Muhammadu Buhari.

”A huge U.S. dollar-denominated debt could be more threatening than a huge Naira debt.

”Government should therefore manage the country’s debt within the framework of debt sustainability.

”The growth in the stock of savings bonds between 2023 and 2024 cannot be said to be life-threatening. That segment of the government securities market is known to be underperforming.”.

The federal government in the 2024 budget had estimated N27.50 trillion total expenditure and N18.32 trillion revenue, leaving the FG with a N9.05 trillion fiscal deficit.

The FG explained that the fiscal deficit is expected to be financed by a combination of domestic borrowings (N6.04 trillion), foreign borrowings (N1.77 trillion), multilateral/bilateral loan drawdowns (N941.19 billion), and privatisation proceeds amounting to N298.49 billion.

RELATED: World Bank Set to Approve $500M Loan for Nigeria

Content Credit| Igbakuma Rita Doom

Picture Credit | https://dailytrust.com/where-is-the-federal-government/