Nigeria’s Debt Rises to N142 Trillion Amid Rising Inflation

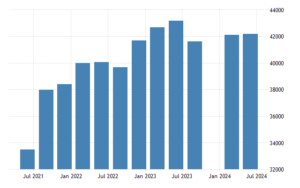

As of September 30, 2024, Nigeria’s total public debt reached N142.3 trillion, reflecting a 5.97% increase from N134.3 trillion in June 2024. This rise was primarily driven by a sharp depreciation of the naira, which significantly affected the value of external debt in naira terms. The country’s external debt in dollar terms grew slightly by 0.29%, from $42.90 billion to $43.03 billion, but in naira terms, it surged by 9.22%, climbing from N63.07 trillion to N68.89 trillion. This was due to the naira’s depreciation from N1,470.19/$ to N1,601.03/$ during the quarter.

On the other hand, Nigeria’s domestic debt in dollar terms decreased by 5.34%, from $48.45 billion to $45.87 billion, but in naira terms, it increased by 3.10%, from N71.22 trillion to N73.43 trillion. The Federal Government’s external debt rose slightly from $38.01 billion to $38.12 billion, while state and FCT debt increased marginally from $4.89 billion to $4.91 billion. For domestic debt, the Federal Government’s obligations increased from N66.96 trillion to N69.22 trillion, while the debt held by states and the FCT decreased slightly from N4.27 trillion to N4.21 trillion.

The exchange rate movements were a key factor in driving the increase in total public debt, especially for external borrowings, which became more expensive when converted to naira.

Nigeria’s total public debt in dollar terms decreased by 2.70%, from $91.35 billion in June 2024 to $88.89 billion in September 2024. Despite this reduction, the debt burden in naira terms has remained substantial, and the sharp depreciation of the naira has raised concerns about the sustainability of the country’s debt, particularly with the increased cost of external obligations.

The Federal Government’s domestic debt stock of N69.22 trillion as of September 30, 2024, was largely driven by the increased issuance of Federal Government bonds and a rise in promissory notes. Bonds, which remain the largest component of domestic debt, rose by 4.47%, reaching N54.65 trillion in September from N52.32 trillion in June, accounting for 78.95% of total domestic debt. A key development in this period was the issuance of Nigeria’s first-ever domestic dollar-denominated bond, valued at N1.47 trillion. The bond, with a 9.75% annual coupon and a 180% subscription rate, marked a significant milestone in the country’s capital market.

Additionally, Nigerian Treasury Bills, the second-largest component of domestic debt, fell by 0.66% from N11.81 trillion to N11.73 trillion, likely reflecting the government’s efforts to manage short-term debt in light of rising interest rates. Promissory notes issued to settle obligations like contractor payments increased by 5.80%, growing from N1.67 trillion to N1.77 trillion. A portion of this growth came from foreign-denominated promissory notes, which rose slightly, reflecting the impact of currency fluctuations. Conversely, FGN Sukuk, a key instrument for infrastructure funding, fell by 9.14%, from N1.09 trillion to N992.56 billion.

The reliance on domestic borrowing, particularly through bonds and promissory notes, underscores the government’s strategy to meet fiscal needs, but the rising debt load and exchange rate volatility pose ongoing risks to debt sustainability.

Nigeria’s growing domestic debt profile continued to be driven by increasing reliance on local markets, with notable developments in various instruments. FGN Savings Bonds rose by 16.11%, reaching N64.09 billion from N55.20 billion, reflecting higher participation from retail investors. However, the Green Bond component remained unchanged at N15 billion, contributing only 0.02% to the domestic debt stock. The overall increase in domestic debt underscores the government’s increasing dependence on local borrowing, particularly in light of limited external borrowing options and constrained foreign exchange reserves.

Concerns about the sustainability of rising debt levels persist, particularly as a large portion of government revenue goes toward servicing the debt. Dr. Muda Yusuf, CEO of the Centre for the Promotion of Public Enterprises, warned of the potential for a debt trap, noting that continued growth in debt service obligations could lead to macroeconomic challenges. Analysts have expressed concerns about the long-term impact of relying heavily on domestic borrowing, especially as the government shifts toward longer-term bonds, which could increase the overall cost of debt servicing.

Looking at Nigeria’s external debt, the stock stood at $43.03 billion by the end of September 2024, with minimal changes. Multilateral debt rose slightly by 0.67%, from $21.62 billion to $21.77 billion, due in part to additional disbursements from institutions like the World Bank. Bilateral loans decreased slightly by 1.33%, with China, Nigeria’s largest bilateral lender, reducing its loan exposure by about $100 million. Commercial loans, mostly composed of Eurobonds, remained stable at $15.12 billion, while syndicated loans and obligations to Deutsche Bank showed only minor fluctuations.

Despite a relatively stable external debt profile, the depreciation of the naira—from N1,470.19/$ in June to N1,601.03/$ in September—has significantly raised the cost of external debt in naira terms. While the government remains cautious about international borrowing, the impact of exchange rate volatility continues to exacerbate the debt burden. Additionally, the country raised $2.2 billion through a Eurobond auction in December 2023, signalling ongoing efforts to manage its fiscal deficit amid growing fiscal pressures.

These dynamics illustrate Nigeria’s complex debt landscape, where increasing domestic borrowing, exchange rate volatility, and a rising debt service burden raise significant concerns about long-term debt sustainability.

Nigeria’s return to the international capital markets through a $2.2 billion Eurobond issuance, after a hiatus since March 2022, highlights the government’s ongoing efforts to address its fiscal challenges. The auction, which saw over $9 billion in subscriptions, resulted in an allotment of $2.2 billion split between two bonds: a $700 million 6.5-year bond priced at 9.625% and a $1.5 billion 10-year bond priced at 10.375%. The funds raised are primarily intended to support the 2024 budget, which has been under strain due to persistent revenue shortfalls and rising public expenditure. This issuance will likely lead to a further increase in Nigeria’s external debt, with data expected to be released by the Debt Management Office (DMO) for Q4 2024.

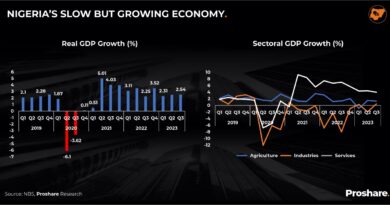

In parallel, the Nigerian government remains focused on boosting revenue generation to fund critical infrastructure and stimulate economic growth. Abubakar Bagudu, Minister of Budget and Economic Planning, emphasised the administration’s commitment to aggressive revenue mobilisation during his 2025 financial estimates presentation to the National Assembly. He credited President Bola Tinubu’s leadership for navigating the economy in the right direction, citing a steady GDP growth of over 3% for three consecutive quarters, in contrast to stagnating growth in many industrialised nations. Bagudu also highlighted a significant reduction in Nigeria’s fiscal deficit, from over 6.1% in 2023 to below 4% in 2024—a development recognised by global business leaders and rating agencies.

See Also: World Bank Bans Two Nigerian Firms Over Corruption

The government’s reforms, particularly the removal of fuel and forex subsidies, have improved liquidity at the subnational level, contributing to an increase in FAAC allocations to states and local governments. This fiscal reform momentum is expected to continue, with the government targeting key sectors such as petroleum, solid minerals, and the creative industries to unlock their revenue potential. Additionally, the administration is focused on funding critical infrastructure, including housing, roads, and railways, through innovative financing mechanisms like the Renewed Hope Infrastructure Fund, consumer credit schemes, and energy transition projects.

Furthermore, Bagudu outlined plans to ramp up Nigeria’s crude oil production beyond the current target of 2.06 million barrels per day, driven by ongoing efforts to combat crude oil theft. He also emphasised the importance of passing key tax reform bills, which are vital to achieving the government’s 18% revenue-to-GDP target.

The government’s focus on inclusive economic growth, bolstered by a combination of fiscal discipline, strategic reforms, and new revenue-generation strategies, aims to secure long-term economic stability and sustainable infrastructure development.

Minister of Budget and Economic Planning, Abubakar Bagudu, also highlighted that Nigeria’s recent economic reforms have earned the country respect from key development partners. He emphasised the strengthening of bilateral relations with countries such as China, the United Kingdom, and the European Union. According to Bagudu, these improved diplomatic and economic ties have resulted in high-level agreements that will bolster Nigeria’s development agenda, providing additional support for the country’s efforts to drive economic growth, infrastructure development, and fiscal reforms. This growing international cooperation underscores Nigeria’s strategic positioning as it seeks to address its fiscal challenges and implement its long-term economic plans.

Content Credit| Agbetan Bisola

Picture Credit | https://smeguide.net/