FG to Cut Dangote Refinery’s Crude oil Supply For New plants

The Federal Government of Nigeria is set to revise its crude oil supply strategy, potentially reducing allocations to the Dangote Petroleum Refinery. This decision follows the reactivation of operations at the Warri and Port Harcourt refineries, which collectively add a capacity of approximately 135,000 barrels per day (bpd) to the nation’s refining capabilities. These developments are part of broader efforts to enhance local refining and reduce dependence on fuel imports.

Currently, the Dangote Refinery receives an allocation of 300,000 bpd under the government’s naira-for-crude initiative. This arrangement was initially designed to support domestic refining and stabilise petrol prices amidst foreign exchange volatility. However, with the Warri and Port Harcourt refineries coming back online, crude allocations will now be redistributed to ensure a fair supply across all operational refineries.

This adjustment reflects the government’s commitment to optimising the use of domestic refining capacity and fostering competition in the downstream sector. Sources within the Nigerian National Petroleum Company Limited (NNPCL) confirm that the revised allocations will consider the increased number of active refineries, including smaller players entering the market.

The naira-for-crude initiative was introduced to address foreign exchange market instability while encouraging domestic production of petroleum products. Under this program, refineries purchase crude oil using the local currency. Initially, 450,000 bpd were allocated for domestic refining, with the Dangote Refinery acting as the pilot recipient of the arrangement.

The initiative has been instrumental in moderating petrol prices, which have recently experienced a decline. Stakeholders believe that expanding refinery operations and consistent crude supply will further stabilise prices, benefiting consumers nationwide.

The Warri and Port Harcourt refineries have resumed operations after undergoing extensive rehabilitation. The Warri refinery, operating at a capacity of 75,000 bpd, and the Port Harcourt refinery, with a capacity of 60,000 bpd, are expected to reduce Nigeria’s reliance on imported fuel. Additionally, the upcoming commissioning of the BUA Refinery and increased activities at smaller facilities such as the Waltersmith and Edo refineries will further diversify the downstream market.

As these refineries ramp up production, the federal government has confirmed its intention to scale back the Dangote Refinery’s allocation, making room for equitable crude distribution. While the specific formula for reallocating crude oil is still under discussion, industry insiders suggest that a proportional reduction in Dangote’s supply is imminent unless there is a significant increase in national crude oil output.

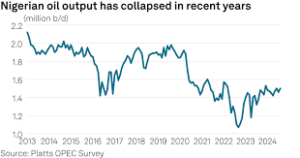

The key to sustaining these new allocations lies in boosting Nigeria’s crude oil production, currently averaging 1.8 million bpd. The government has launched several initiatives, including the “Project 1 Million Barrels,” aimed at increasing production to over 2 million bpd by mid-2025.

Moreover, the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has forecasted a daily crude requirement of 770,500 bpd for local refiners during the first half of 2025. Meeting this demand will require increased collaboration between upstream producers and refineries.

Another significant change involves the government’s decision to discontinue crude sales on credit terms. Moving forward, refineries must make upfront payments for crude supplies. While this policy is aimed at improving revenue collection, it has faced resistance from refinery operators, who argue that it places additional financial strain on their operations. Nonetheless, the government asserts that this measure is necessary to ensure fiscal stability and maximise earnings from oil exports.

Private refineries, including the Dangote Refinery, remain critical to Nigeria’s energy landscape. The Dangote Refinery, with a full capacity of 650,000 bpd, has been pivotal in reducing the nation’s dependency on imported fuel. However, recent statements from Dangote Group executives highlight challenges in securing the agreed crude supply from NNPCL, with current deliveries falling short of the 385,000 bpd commitment.

The Crude Oil Refinery Owners Association of Nigeria (CORAN) has called on the government to address these supply issues and provide private refineries access to marginal oil fields. Such measures could ensure a steady supply of crude, enabling refineries to operate at optimal capacity and further stabilising the downstream sector.

Tinubu: Warri Refinery Reopening A Key Achievement in 2024

The NUPRC has projected that nine active refineries, including Dangote, Warri, Port Harcourt, and smaller facilities, will require a total of 123.48 million barrels of crude oil during the first half of 2025. This figure underscores the urgent need for increased production to meet domestic demand while maintaining export commitments.

To achieve this, the government is pursuing additional investments in upstream infrastructure. Recent reports indicate that NNPCL is finalising a $2 billion syndicated loan, secured through crude oil-backed agreements, to finance production expansion. This initiative aligns with Nigeria’s broader strategy to enhance self-sufficiency in fuel production and reduce exposure to global market volatility.

The federal government’s decision to revise crude oil allocations marks a significant step toward strengthening Nigeria’s refining sector. By redistributing supply among multiple refineries, encouraging domestic production, and fostering competition, the nation is poised to achieve greater self-reliance in fuel production. However, realising these goals will require increased crude output, policy consistency, and active collaboration between public and private stakeholders. If these challenges are effectively addressed, Nigeria could emerge as a model for sustainable energy management in Africa.

Content Credit| Ajibola Emmnauel Adebayo

Picture Credit | https://www.premiumtimesng.com/