IMF Cites Nigeria’s High Borrowing as Economic Growth Slows

The International Monetary Fund (IMF) says that Nigeria’s involvement in the global debt market remains strong despite the high borrowing costs.

Speaking at a press conference on the global financial stability report during the IMF/World Bank annual meetings in Washington, DC, Tobias Adrian, the IMF’s financial counsellor and director of monetary and capital markets, stated that Nigeria and other frontier markets have sustained considerable activity in the debt market throughout 2024, even though financing costs have risen significantly compared to pre-2021 levels.

He said, “Frontier markets, including Nigeria, have been active in the debt market this year, and though access to financing is still more expensive than before, the overall issuance levels have been encouraging.”

The IMF voiced its support for Nigeria’s recent monetary policy actions, specifically the Central Bank’s interest rate increases and foreign exchange reforms, which are aimed at stabilising the economy.

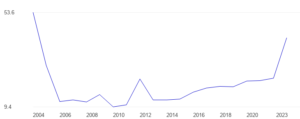

Adrian highlighted the importance of the Central Bank of Nigeria’s move toward inflation targeting and its efforts to liberalise the exchange rate in tackling inflation, which remains near 30 percent.

He also emphasised the significance of these reforms, especially in light of inflationary pressures exacerbated by recent natural disasters, such as floods, which have further deteriorated living conditions for many Nigerians.

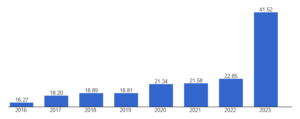

The IMF has revised its economic forecast for Nigeria, predicting slower growth for the country in 2024. The World Economic Outlook report released on Tuesday says Nigeria’s economy is now expected to grow by 2.9 percent in 2024, matching the growth rate recorded in 2023. This projection marks a 0.2 percent reduction from the July forecast and a 0.4 percent decrease from the April forecast.

This adjustment reflects the IMF’s cautious outlook on the challenges confronting emerging markets, including Nigeria.

The international lender stated that “the revision reflects slower growth in Nigeria, following weaker-than-expected economic activity in the first half of the year.”

Jean-Marc Natal, Deputy Chief of the IMF’s Research Department, further explained Nigeria’s growth challenges, citing disruptions in agriculture and oil production as key reasons for the downgraded growth forecast.

He said, “We revised growth for Nigeria 2024 by 0.2 percent down. Things are volatile because the reason for the revision is precisely issues in agriculture related to flooding and issues in the production of oil related to security and maintenance that have pushed down the production of oil. So, these two factors have played a role.”

The IMF also pointed out that its projected growth for Nigeria in 2025 is 3.2 percent, which is 0.2 percent higher than its July and April forecasts. However, this projection is notably lower than that of the World Bank for both 2024 and 2025.

According to the latest edition of *Africa’s Pulse*, a World Bank report, Nigeria’s gross domestic product is expected to grow by 3.3 percent in 2024 and slightly increase to 3.6 percent in 2025-2026.

The Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, also held strategic discussions with IMF Managing Director Kristalina Georgieva during the annual conference.

According to a statement from the ministry on Tuesday, the talks focused on Nigeria’s economic growth outlook and the progress achieved under President Bola Tinubu’s reform agenda.

The statement read, “Leading Nigeria’s delegation, Edun will be at the forefront of discussions on strengthening Nigeria’s economic resilience, particularly amid the nation’s ongoing structural reforms.

“He is expected to make a case for increased international support to ensure the success of these domestic initiatives, emphasising that access to adequate and affordable financing is critical to maximising the benefits of the country’s economic adjustments.”

READ: MTN Warns of Shutdown Without Tariff Hike Amid Losses

During the G-24 leaders’ press conference at the IMF-World Bank meetings on Tuesday, Edun advocated for concessional loans from the IMF and World Bank to support Nigeria and other nations undertaking economic reforms.

He said, “The issue that we are contending with in Africa is that in many ways we are bystanders to this all-important election. Yes, we do have the African Growth and Opportunities Act, which tries to open up the US market to African-manufactured products; I don’t think that will be affected in any way by the result of this election.

“And generally, what we are finding is that at this particular time, the economies of trade generally, there is a reversal of globalisation of trade, there is a move to protectionism in these countries, there is the onboarding of production and all these things tend to work against the developing world’s ability to benefit from expanding trade.

“And thereby use that opportunity for investment for growth, job creation, and poverty reduction. So, overall, I think that we are not that affected specifically but that in general, we continue to ask for an improved global financial architecture that provides us with more concessional funding at scale, particularly for those countries that are undertaking the macro-economic reforms that everybody agrees are sensible and will lead to better lives for their people.”

Edun emphasised that these loans are essential for backing reform programs designed to achieve macroeconomic sustainability while protecting the poor and vulnerable from the immediate costs of adjustment policies.

He said, “When we talk about debt sustainability and reform generally, the requirement for support from the international community, from the development partners, and the multilateral development banks is that you undertake reforms that lead to sustainability at the macro level.

“The key lesson that I think I would focus on is that in devising these programs and carrying out all the reforms, what is particularly important because the benefits over the longer term and the costs are front-loaded, the social safety net that will help the poor and the vulnerable cope with the upfront cost in the spike in the cost of living must be adequately planned for and dealt with.

“Linked to that focus on helping the poor and the most vulnerable is communication. I think one of the critical things in carrying out these macroeconomic reforms that are so fundamental is communicating what is being done, what is to be expected and the timing as much as possible and then communicating what has been done.”

The finance ministry’s statement also indicated that the Central Bank of Nigeria, under the leadership of Governor Yemi Cardoso, is set to host a session called “Strengthening Ties with Nigerians Abroad.” This discussion will focus on ways the Nigerian diaspora can enhance remittance inflows, which are crucial for sustaining foreign exchange reserves during fiscal difficulties.

Content Credit| Igbakuma Rita Doom

Picture Credit | https://blog.q-tickets.com/2020/10/16/the-international-monetary-fund/